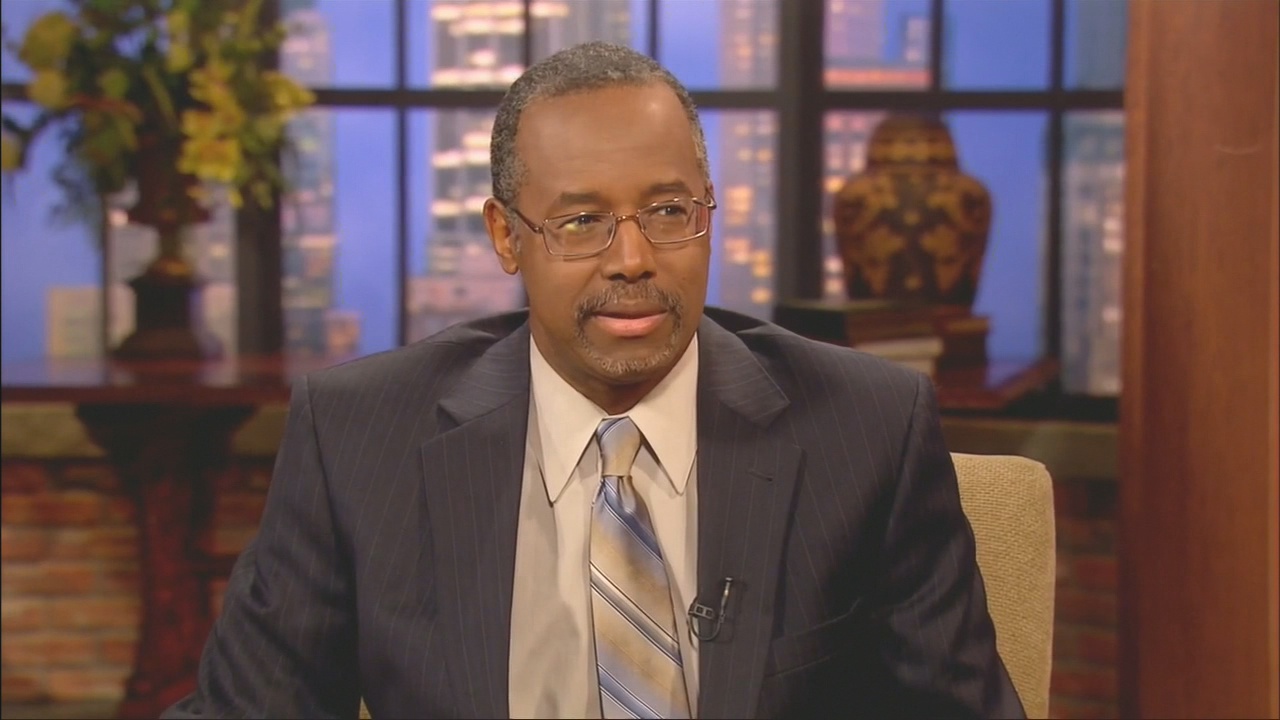

Ben Carson: ‘The Lord’ Told Me To Push A ‘Flat Tax’ Because Poor People Don’t Pay Enough (via http://crooksandliars.com)

Ben Carson: ‘The Lord’ Told Me To Push A ‘Flat Tax’ Because Poor People Don’t Pay Enough (via http://crooksandliars.com)

By David May 29, 2014 12:58 pm – Comments Former neurosurgeon Ben Carson on Thursday explained that he had been following God’s instructions when he shocked many people by calling for a flat tax at a non-partisan prayer breakfast with President Barack…

This is exactly what America needs. A president who hears voices.

All throughout time leaders acted on voices or their dreams to make decisions. I know it sounds bad today, but back in the early days of life, say back in the days of Cleopatra, hearing voices or listening to Oracles was the meme or order of the day for leaders. If they didn’t worship at the alters of the gods or give blood sacrifices they just weren’t leading the people. Also, didn’t Moses hear voices from the burning bush? I wonder how we would react today if the leaders of the world said they were given instructions to launch nuclear weapons from burning bushes lol?

He’s not hearing from God, that’s for sure, or he’d be saying the same thing as the Bible. There were 3, possible 4 tithes. The poor didn’t tithe, they received of the tithe. Only those who made their living off the land tithed. He needs to go read his bible before he starts spewing nonsense.

I was disappointed to learn that this was the same Ben Carson who’s book I had to read the summer before my freshman year in high school.

2 words…bath salts

Or ecstasy or 4 way hits of window pane or even some purple haze or orange sunshine. Bath salts are so today..

These guys gotta be careful what they wish for. A flat Federal income tax would have more than doubled the taxes Mitt Rmoney (a typo I’m going to leave there…) pays.

In Canada pre-GST the lowest taxed segment of the population was the ninth decile of oveall earners, at that time people making $68K to $116K a year: they paid *less* than anybody else, the poorest included. A “flat” goods and services tax is an increase in taxes for this decile.

Consumption taxes are *theoretically* regressive — but when you have large percentages of the rich and near rich paying nothing, any increase is *relatively* progressive.

Net net, the best way to increase overall equality in the US is to tax consumption and tax-credit poverty.

-dlj.

Don’t we pretty much already pay a consumption tax on cigarettes, and by that measure gasoline? Plus, it always seems that the good old USA has plenty of money to send money to other countries by the billions for whatever ails them, yet we are always too broke to fund infrastructure such as road repairs and schools and much needed upgrades to equipment for local governments, and this despite having enough money to send billions of dollars elsewhere outside of the country for what amounts to nothing more than slush funds for those we send it to.

Now because government is supposedly broke, we all face austerity cuts and we suddenly start talking about consumption taxes on every day items that are what governments think are luxury items to the populace. Tobacco taxes are some of the worst consumption taxes around. Of course the government says tobacco is evil or bad, but does nothing to curb addictions to it by corporations who add additives that make it nearly impossible to quit. But they sure will tax the living shit out of it if you want to smoke it. And exactly where does that money go?? Do we the people ever see where it is spent dollar for dollar? Or does it just go into one of those mystery boxes like the Lottery money does?

Hofenbrau,

You ask “Don’t we pretty much already pay a consumption tax on cigarettes, and by that measure gasoline?”

Yes, those are two specific examples of excise taxes on goods. The two isolated excise taxes to not add up to a consumption tax, which would be on, uh, consumption.

An example of a stupid consumption tax would be a general excise, or sales, tax on things bought, such as many American cities and states levy. Things are what poor people spend all their income on. In an advanced economy most “goods” are in fact services, so a sensible consumption tax would be a Value Added Tax on both goods and services.

is so often the case, the United States can learn from looking at a government run by grown ups, e.g. Canada, the Commonwealth, or Scandinavia. I think Canada’s GST system is pretty god.

Since the upper middle classes — yes, you have social classes in the US — are both the main producers and the man consumers of services, and since they are also the main producers and consumers of tax evasion, a tax on service is the first time a lot of these folks are ever going to pay a tax.

Oddly you write ” Tobacco taxes are some of the worst consumption taxes around. Of course the government says tobacco is evil or bad, but does nothing to curb addictions to it by corporations who add additives that make it nearly impossible to quit.”

Um, the intention of the high taxes on tobacco is to encourage people to smoke less. Guess what: it works.

You ask ” And exactly where does that money go?? Do we the people ever see where it is spent dollar for dollar? Or does it just go into one of those mystery boxes like the Lottery money does?”

It goes into General Revenue. Yes. No.

Find out how the budget work here: http://en.wikipedia.org/wiki/United_States_federal_budget

Take a look at the current budget here:

http://www.whitehouse.gov/omb/budget/

And please stop whining. It makes you sound like a Republican.

-dlj.

DLJ, you had me at hello, I was actually commending your fine comment until I read that you considered me whining and sounding like a Rethuglican lol. That is where we part company when you start name calling lol.

Smoking less? Hell I remember the day when cigs were 20 cents a pack and we all said we would quit when they reached 50 cents a pack, then a dollar a pack. They are almost 7 dollars a pack now and its even harder to quit than it was before. Ask any smoker and he will say the same. I quit lots a times is a usual response, but long term quitting is very, very, hard to do. You could tax the living shit out of it and smokers who are addicted to it majorly would still find a way to pay for it. So to me its a consumption tax. I consume it, they tax it because I consume it, therefore it is a consumption tax.

As for budgets, I know budgets, but going to read how money is spent is often like John Oliver said the other day, impossible to know what the hell one is reading its so boring. Can you tell me just how much they made last month on lottery sales and exactly where that money went dollar for dollar right now without spending two months trying to find it? Maybe an app for that would be great eh?

And guess what; money flows into government and gets spent without me even having a say over it. I am sure many people wonder why money goes to support dictators around the world when we as a people never had a say in that decision. And don’t lecture me about voting some guy in office and I should ask him about it. Try calling your local senator or rep and see if he will actually talk to an average joe constituent. He won’t. He has screeners that take your calls and questions and then promptly hangs up forgetting you ever called.

Anyway, again, I thank you for your very nice comment. Just don’t start name calling 🙂

Hof,

You’re quite right that a tobacco tax is one of many possible consumption taxes. You’re also right that tobacco is addictive. So? Good luck quitting.

When I quit I promised not to become a tobacco fascist, and in fact I enjoy a good cigar every now and then, which is to say once in every few years. What helped me quit the several times it took me to eventually get off it for the last many many years was a series of phone-ins made available by the Jehovah’s Witnesses or some such group: they just had seven, I think it was, simple encouraging messages that changed every day, and you phoned them whenever you felt like smoking. Helped me, but I’m sorry, I don’t know what it was called. Anyway, good luck: smoking cigarettes is re-eealy stoo-pid, and a huge waste of money besides.

On where your money goes, I don’t know how to help you. The fact is an economy is a big complicated machine, and nothing is going to make it simple.

But your time is maybe better spent researching it than bitching and moaning about how hard it is to figger out.

Again, good luck.

-dlj.

you must remember, if you read his book Gifted Hand, you will read that his mother suffered from mental illness. Clearly, he also suffers from the same illness.

A 10% tax on someone who makes $10/hr causes that person a lot more hurt than a 10% tax on someone so wealthy that he doesn’t even know how many houses he owns, or on someone who doesn’t think 47% of the population doesn’t want to work, or on someone who firmly believes that corporations are people, but shouldn’t be taxed like them.

A 10% tax on someone who draws disability causes that person a lot more pain than a 10% tax on someone who can afford to invest, since investment returns are taxed so much lower than earned income is.

A 10% tax is a good idea to someone who thinks he can sell unfairness as fairness, and the LORD is not the author of such a thing. Carson can’t prove he’s quoting God, but I can open a BIble and prove he’s quoting an Old Testament ideal.

How can this proposal be regarded as anything but poorly thought and cowardly?

It’s a serious mistake to think that the voice you head is the voice of “god”. It is still called “crazy” even or especially “crazy” if you choose to hide behind some sort of religion to justify your craziness. If you think god is talking to you, the rubber room awaits.